Home > Insight > IT Business

How ERP Accounting System Help in Managing Cash Flow and Reducing Errors

5 minutes read

Audio description available

December 13, 2024

Managing cash flow and reducing errors are challenges that every business faces, no matter the size or industry. An ERP accounting system can be the solution you need.

Many companies still rely on outdated tools or manual processes, leading to missed transactions, inaccurate reports, or time-consuming corrections. These inefficiencies can slow growth and drain resources. By adopting ERP software, businesses gain access to integrated accounting solutions that streamline operations and enhance accuracy. This blog delves into how the ERP accounting system addresses the challenges and why they are essential for modern businesses.

1. What is an ERP Accounting System?

1.1. Definition of ERP Accounting System

An ERP accounting system is a type of Enterprise Resource Planning software built to streamline financial management. It integrates various financial functions like accounting, inventory management, payroll, and more into a single platform. This creates a centralized system where businesses can track, manage, and analyze their finances in real time.

Think of it as an all-in-one business management software that connects the dots between your accounting needs and other operational areas. Whether it’s generating invoices, monitoring cash flow, or managing budgets, an ERP accounting system keeps everything organized and efficient.

By offering a unified view of your company’s financial operations, this system helps eliminate data silos and reduces the chance of errors. It’s especially helpful for SMEs looking for cost-effective ERP accounting software options that scale with their business growth.

1.2. Key features of ERP Accounting System for cash flow management

An ERP accounting system is packed with tools to make managing cash flow easier and more accurate. Here are some standout features that can transform how businesses handle their finances:

- Centralized financial data

Everything is in one place. From expenses and revenues to transactions, all financial activities are tracked on a unified platform. This eliminates scattered data and ensures you always have a clear picture of your cash flow. - Real-time insights

Say goodbye to outdated spreadsheets. With real-time financial reports and dashboards, you can access up-to-date information whenever you need it. This helps decision-makers respond quickly to changes and plan better. - Automation

No more repetitive manual tasks. The system automates processes like invoicing, payment processing, and bank reconciliations. This not only saves time but also reduces errors that come from human input. - Customizability

One size doesn’t fit all. That’s why the best ERP accounting systems come with tailored modules designed for specific industries like healthcare, education, retail, or e-commerce. This means your system works the way your business needs it to.

These features make an ERP accounting system an essential tool for businesses, especially SMEs. Now let's explore how an ERP accounting system makes managing cash flow easier and more effective.

Learn more: Legacy Modernization And Transformation Services

2. How ERP Accounting System improve cash flow management

2.1. Real-time financial data and cash flow visibility

Imagine running a business without knowing exactly how much money is coming in or going out—it’s like driving blindfolded. That’s where an ERP accounting system steps in to save the day.

With real-time financial data, businesses get a clear, accurate picture of their cash flow at any moment.

- Instant updates

ERP systems provide up-to-the-minute updates on critical financial information. Whether it’s account balances, pending invoices, or upcoming payments, you always know where your cash stands. - Improved decision-making

Having real-time visibility means you can make smarter decisions faster. For instance, if your business sees an unexpected expense coming up, you can adjust spending or prioritize invoice collections to stay ahead. - Transparency across teams

Real-time dashboards allow multiple departments to stay on the same page. For example, the sales team knows how much budget is available for client discounts, while the finance team monitors cash reserves. - Avoiding cash flow gaps

With clear insights into cash inflows and outflows, businesses can better predict when they might face a shortage. This helps them secure loans or delay payments to avoid operational hiccups.

2.2. Automated invoicing and payment processing

Handling invoices and payments manually can feel like juggling too many balls at once. One mistake, and it all comes crashing down. That’s why an ERP accounting system is a game changer—it automates these workflows, saving time and reducing stress.

- Faster invoicing

With automation, invoices are generated and sent to clients immediately after a sale. No more waiting days or forgetting to follow up. This speeds up the accounts receivable process, meaning your cash gets to you faster. - Streamlined payment processing

ERP systems handle payments seamlessly. For instance, vendor payments can be scheduled and processed automatically, avoiding late fees and keeping relationships strong. - Minimizing delays

Forget about chasing overdue payments manually. An ERP system sends reminders to clients automatically, helping you avoid cash flow disruptions without the awkward emails. - Reduced admin overhead

Automation means fewer repetitive tasks for your team. Instead of spending hours inputting data or chasing payments, they can focus on more strategic activities like growing the business.

2.3. Forecasting and cash flow projections

Planning for the future is tough when you’re unsure about your finances. This is where an ERP accounting system steps in, turning guesswork into strategic forecasting. By using historical data and predictive analytics, it helps businesses prepare for what’s ahead - whether it’s a seasonal sales surge or unexpected expenses:

- Accurate predictions

With access to past financial data, an ERP system analyzes patterns to forecast future cash inflows and outflows. This ensures your business can spot trends and adjust accordingly. - Better budget planning

Cash flow projections show where your money will be and when. This helps you allocate funds wisely, ensuring there’s enough for payroll, inventory, or new investments. - Preparedness for seasonal trends

For example, a retail business might see a spike in sales during the holiday season but slower months afterward. An ERP system forecasts these trends, so you can plan ahead, like stocking up inventory or managing staffing needs.

2.4. Integration with bank accounts for seamless transactions

Keeping financial records up-to-date can be a hassle, especially when managing multiple bank accounts. But with an ERP accounting system, this becomes effortless. By integrating directly with banking platforms, businesses can streamline their transactions:

- Automated updates

The ERP system syncs with your bank accounts, automatically recording transactions as they happen. Whether it’s a payment received or an expense paid, you’ll have real-time updates without manual input. - Simplified reconciliation

Matching bank statements with financial records is no longer time-consuming. The system compares records and flags discrepancies, making reconciliation quicker and more accurate.

Along with improving cash flow management, an ERP accounting system also plays a big role in reducing errors in financial management.

Learn More: HR Management Software Solutions

3. How ERP Accounting System help reduce errors in financial management

3.1. Automation of repetitive accounting tasks

Manual accounting tasks like data entry, invoicing, and payroll are often time-consuming and prone to mistakes. An ERP accounting system solves this by automating these processes, ensuring accuracy and saving time.

For example, instead of manually creating invoices, the system generates them using predefined templates, reducing errors. Similarly, payroll tasks like calculating salaries, taxes, and benefits are handled by integrated accounting solutions, making the process smooth and reliable.

With automation, businesses can focus on planning and strategy instead of repetitive tasks. This means fewer errors, less stress, and more efficiency in financial management.

3.2. Enhanced accuracy through integration across business functions

An ERP accounting system improves accuracy by connecting all your business functions (sales, inventory, HR, and finance) on one platform. This integration ensures everyone works with the same, up-to-date data, reducing errors caused by mismatched or duplicate entries.

For example, when a sale is made, the system updates inventory and records the revenue in your accounts instantly. Payroll expenses, logged in real time, are automatically reflected in your financial data. With everything synced, you avoid the confusion and mistakes that happen with separate systems.

Using integrated accounting solutions, businesses save time by eliminating the need to reconcile conflicting numbers. Your team gets accurate, real-time data, making decisions faster and with more confidence. It’s all about efficiency and precision in one seamless system.

3.3. Improved compliance and error-free reporting

Staying compliant with financial rules is easier with an ERP accounting system. These systems follow industry standards and help create accurate, error-free reports. For example, many Enterprise Resource Planning software tools have templates for tax filings and financial statements that meet local and global regulations.

By automating calculations and pulling real-time data, the system reduces mistakes. If there’s a problem, built-in alerts let you fix it quickly. Plus, the system keeps a detailed record of all transactions, making audits simple and stress-free.

With accurate reporting and better compliance, businesses save time, avoid fines, and focus on growth.

3.4. Audit trails and error detection features

An ERP accounting system is like a digital detective. It tracks every financial move, from payments to invoices, creating an audit trail. This trail helps you find mistakes quickly, like a missing dollar in a puzzle.

Imagine a system that automatically spots errors, like double entries or mismatched numbers. It's like having a watchful eye on your finances.

These features make your accounting more accurate and reliable. Plus, they're great for audits, proving your financial health to regulators and stakeholders.

4. The power of a customized ERP Accounting System

4.1. Tailored solutions for unique business needs

Every business is different, so why settle for a one-size-fits-all approach? A customized ERP accounting system offers tailored solutions that fit your specific operational needs, unlike generic systems that might lack the flexibility to meet your unique requirements:

Industry-specific features

Whether you're in healthcare, retail, or education, a tailored system can include specialized modules to address your industry's challenges. For example, healthcare businesses can integrate billing with patient records, while retailers can link accounting to inventory.

- Optimized workflows

A custom ERP system aligns with your internal processes. This reduces unnecessary steps and streamlines operations, saving time and boosting efficiency. - Scalability

As your business grows, your system can grow with you. Adding new features or accommodating higher transaction volumes becomes seamless with a business management software tailored to your needs. - Better user experience

Tailored systems are designed with your team in mind. From intuitive dashboards to personalized reporting tools, everything is built to enhance usability and productivity.

4.2. Seamless integration with existing systems

Switching to a new system doesn’t mean starting from scratch. A well-designed ERP accounting system integrates seamlessly with your existing tools, ensuring smooth operations without disrupting workflows:

- Unified data flow

An integrated financial management system connects your accounting software with tools like sales, inventory, and HR platforms. This eliminates data silos, providing a single source of truth for all departments. - Streamlined processes

For instance, syncing your ERP with payroll software automates salary calculations and tax deductions, saving time and reducing manual errors. Similarly, integrating with inventory systems ensures accurate financial reporting tied to stock levels. - Cost and time savings

Instead of juggling multiple disconnected tools, an integrated system simplifies operations. This reduces IT management costs and improves team productivity. - Scalable solutions

As your business grows, seamless integration makes it easy to add new tools or modules. Whether it’s CRM software or e-commerce platforms, an integrated ERP adapts to your evolving needs.

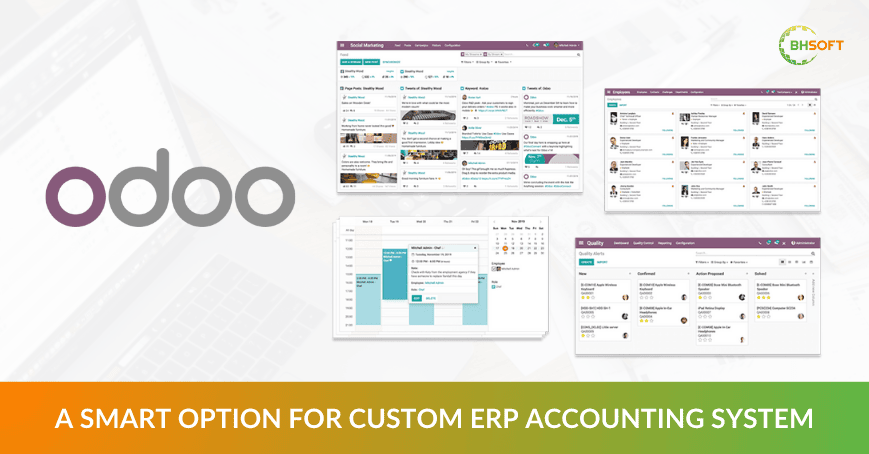

4.3. Odoo - A Smart Option for Custom ERP Accounting System

When it comes to creating a tailored ERP accounting system, Odoo stands out as one of the most versatile platforms available. Its modular design and extensive features make it a favorite among businesses looking to optimize their operations:

- Flexible and modular

Odoo offers a range of modules, including accounting, sales, inventory, and HR. You can pick and choose what you need, creating a system that’s perfectly aligned with your business goals. - Cost-effective

Unlike many other enterprise resource planning software options, Odoo provides robust functionality without breaking the bank. It’s ideal for SMEs looking for high-quality, affordable solutions. - User-friendly

With an intuitive interface and easy-to-navigate design, Odoo simplifies complex processes. Whether it’s managing finances or tracking inventory, Odoo makes it accessible for all users. - Highly customizable

Every business is unique, and Odoo allows you to customize modules to fit specific needs. From financial management systems for healthcare to integrated accounting solutions for retail, the possibilities are endless.

Conclusion

Efficient cash flow management and error reduction are vital for business success. An ERP accounting system simplifies these processes by integrating financial operations, providing real-time data, and automating repetitive tasks.

Ready to take control of your finances? Explore BHSoft’s Odoo Customization Solutions for tailored ERP accounting systems designed to fit your industry needs. Whether you operate in pharma, education or retail,... our solutions help you optimize workflows and achieve long-term growth.