Home > Insight > IT Business

IT Outsourcing Trends in 2026: Key Statistics & Forecasts

Audio description available

5 minutes read

Are you looking to gain a competitive edge in today's rapidly evolving business landscape? The IT outsourcing industry continues to transform, driven by technological advancements and the constant need for businesses to remain agile. In this article, BHSOFT will help you explore key IT outsourcing trends, statistics, and forecasts for 2026, providing a comprehensive overview for organizations aiming to leverage outsourcing effectively.

IT Outsourcing Trends: General Outsourcing Statistics

Before diving into the specifics of IT outsourcing trends, it's important to understand the broader context of the overall outsourcing market. These general outsourcing statistics provide valuable insights into the factors driving adoption across various industries, many of which directly influence IT outsourcing decisions.

IT outsourcing market size (current / 20252026): Multiple major research sources estimate the global IT outsourcing market at ~$588B$618B in 2025, with continued growth projected through 2026 and beyond. (Figures vary across research firms.)

Growth rate (CAGR) / outlook toward the end of the decade: Industry forecasts predict a mid-term CAGR of ~3.5% to 6.5%, depending on methodology suggesting a steadily expanding market heading into 20292030.

Adoption among large enterprises: Consolidated reports indicate that the majority of large corporations (G2000 / Global 2000) rely on outsourcing for at least one IT function, with several sources citing ~90%+ adoption among top enterprises a strong signal of how mainstream outsourcing has become.

Intent to increase outsourcing: Industry surveys (Computer Economics / Avasant) show that ~49.6% of organizations plan to increase their outsourcing levels in the near future, while only around 10% expect to reduce it underscoring growing demand across sectors.

Shift in delivery models toward managed and outcome-based services: KPMG and related reports highlight a notable change in expectations. Many companies now view managed services and outcome-based delivery models as the primary approach, with over 80% of surveyed leaders believing modern managed services are essential for achieving strategic outcomes such as resilience, trust, and business growth.

Rising demand for tech consulting & transformation services: Industry analyses project that the global technology consulting market will surpass ~$400B by 2026, reflecting increased demand for system modernization, AI-driven initiatives, and broader digital transformation services.

IT Outsourcing Trends: Industry Statistics on Outsourcing

Key Trends in IT Outsourcing Statistics

Now, let's turn our attention to the specific statistics shaping the IT outsourcing landscape. These figures provide concrete evidence of the growth, trends, and key areas of focus within the IT outsourcing market.

In 2025, the global IT outsourcing market revenue is projected to be in the hundreds of billions of dollars, with multiple major market research reports estimating figures in the range of approximately USD 588 – 662 billion globally. This underscores the significant and growing reliance of businesses worldwide on external IT service providers for cost optimization, specialized skills, and managing complex technology needs.

The Global Software Outsourcing Market (broader software development outsourcing) is also experiencing strong demand, with estimates showing the market standing at around USD 564 billion in 2025 and forecast to grow toward USD 897 – USD 897.9 billion by 2030/2031, reflecting robust and expanding demand for external development, maintenance, and innovation support.

The offshore software development market was valued at approximately USD 122 billion in 2024 and is expected to reach about USD 283 billion by 2031, highlighting the growing preference for geographically distant teams to deliver cost savings, access global talent, and expand development capacity.

Companies are increasingly considering outsourcing strategic technology leadership roles, with surveys indicating that about 34% of organizations are likely to outsource the Chief Technology Officer (CTO) role, and around 30% are likely to outsource Chief Information Security Officer (CISO) and Chief Information Officer (CIO) roles within the next year. This trend reflects a shift toward leveraging external expertise for high-level technology strategy, security oversight, and IT management.

Read more: Low-code and no-code: How do they compare?

IT Outsourcing Trends: Business Process Outsourcing Statistics

Business Process Outsourcing (BPO) continues to be a crucial strategy for businesses looking to streamline non-core operational tasks. While distinct from IT outsourcing, BPO often relies on IT infrastructure and services. Here are some noteworthy statistics highlighting current BPO outsourcing trends:

In 2025, the global Business Process Outsourcing market revenue is projected to reach approximately USD 263.8 billion, reflecting strong and sustained demand for outsourced business operations across industries. This projection underscores how companies increasingly depend on external providers to handle non-core functions in order to improve efficiency, reduce costs, and access specialized capabilities.

Among different BPO services, customer service, finance & accounting, human resources, and IT-enabled services (including support functions) remain dominant due to their high outsourcing demand, driven by the need for operational scalability and technological integration. While exact percentages vary by sector and region, these categories consistently rank among the most frequently outsourced business processes globally.

In the United States, the BPO services market continues to grow, with revenue estimated at around USD 146.3 billion in 2024 and a projected sustained growth trajectory. This steady expansion highlights the ongoing reliance of U.S. companies on outsourcing to manage back-office and customer-facing operations efficiently.

Regarding cost metrics, the average spend per employee in the BPO market is projected to be approximately USD 649 in 2025. This figure reflects the relative cost-effectiveness of outsourcing compared to direct labor costs, especially in large-scale process functions.

Overall, these statistics demonstrate that BPO remains a major force in global business strategy, enabling organizations to focus resources on core activities while leveraging specialized external expertise for support functions ranging from customer care and accounting to IT-related processes.

Read more: AI-Powered Modernization for Legacy Systems: How To Get Started

IT Outsourcing Trends: Global Statistics

Key U.S. IT Outsourcing Trends

The United States plays a dominant role in the global outsourcing market, significantly influencing the IT outsourcing trend worldwide. Here’s a look at key statistics related to IT outsourcing in the US:

Approximately 66% of U.S.-based companies outsource at least one function, illustrating that outsourcing remains a widespread and established business practice rather than a declining trend. This adoption covers everything from IT support to business processes, enabling firms to improve efficiency and focus on core activities.

Every year, around 300,000 jobs are outsourced from the United States to providers abroad — a figure that highlights the substantial impact of outsourcing on the domestic labor market and corporate workforce strategies.

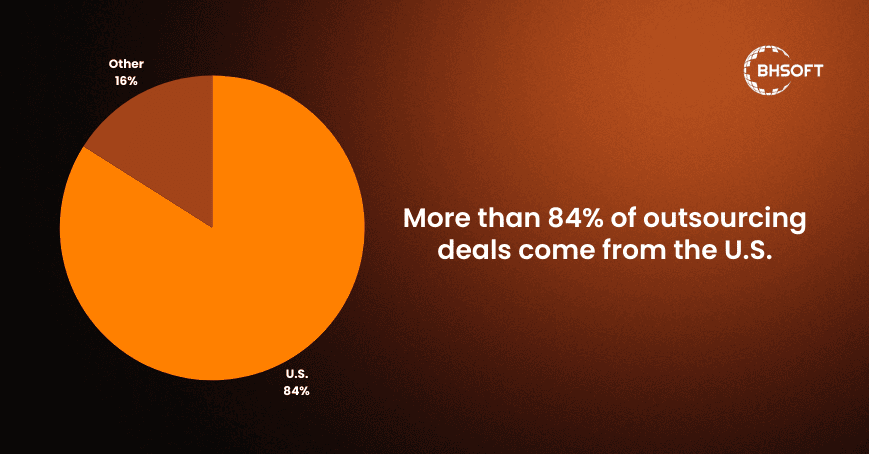

The U.S. also accounts for a major share of global outsourcing deals, with estimates indicating that North America (especially the U.S.) constitutes around 33–42% of foreign outsourcing purchasers, demonstrating the country’s continued leadership in outsourcing demand.

In terms of market revenue, the U.S. IT outsourcing sector is estimated at around USD 191.3 billion in 2025, and it is forecast to grow to around USD 245.3 billion by 2030, driven by demand for cloud services, AI capabilities, and digital transformation initiatives.

The United States is experiencing a rising demand for IT outsourcing services, as businesses seek cost-effective ways to streamline operations, access specialized technical skills, and accelerate innovation — a trend that continues to influence both domestic and global IT outsourcing landscapes.

IT Outsourcing Trends in Asia

Asia remains a dominant force in the global outsourcing market, significantly shaping the IT outsourcing trend due to its large skilled workforce and cost-effective solutions.

By the end of 2025, the Asia-Pacific IT outsourcing market is projected to reach approximately USD 129.78 billion, driven by demand for cost-efficient software development, support services, and technical expertise. This reflects strong regional growth as a global outsourcing hub.

India continues to lead as a major global IT outsourcing destination due to its vast technical talent pool and developed outsourcing ecosystem. Other countries in the region, such as China and the Philippines, also play key roles — with China’s IT outsourcing revenue estimated at about USD 31.31 billion in 2025 and the Philippines remaining significant in BPO and customer support services.

In the Philippines, business process outsourcing contributes about 9% of the country’s GDP and employs millions of workers, underscoring the sector’s economic importance and influence on IT-enabled services.

China’s outsourcing industry continues to expand rapidly, with sources reporting over 1 million new workers joining the services outsourcing sector each year, highlighting its scale and workforce growth.

IT Outsourcing Trends in Europe

Europe’s outsourcing market is experiencing steady growth, driven by digital transformation and demand for specialized skills, contributing to global IT outsourcing trends.

In the United Kingdom, research shows that about 70% of B2B companies outsource key business operations, demonstrating very high adoption of outsourcing practices across IT, marketing, customer support, and other functions.

Eastern Europe, including countries like Poland and Ukraine, is emerging as a significant hub for IT outsourcing due to a strong pool of tech professionals, competitive pricing, and increasing exports of IT services. The region’s growth is expected to continue as more companies leverage nearshore talent for software and support functions.

Across the EU, cybersecurity outsourcing is on the rise, with over half of EU companies outsourcing cybersecurity tasks in 2024. This trend reflects growing reliance on specialized external expertise to combat advanced threats, though specific country-level proportions vary across industries and regions.

Learn more: Software Product Development Services

IT Outsourcing Trends in LATAM

Latin America (LATAM) is increasingly becoming a competitive player in the global outsourcing market, especially for nearshore services to North America.

Projections estimate the IT outsourcing market in LATAM will reach around USD 18.45 billion by the end of 2025, reflecting notable regional growth fueled by competitive labor costs, skilled professionals, and favorable time zone overlap with U.S. companies.

In LATAM, countries such as Brazil and Mexico are among the top contributors to outsourcing revenues. Brazil, for example, is forecasted to generate roughly USD 6.76 billion in IT outsourcing revenue in 2025, making it a key player in regional services.

The growth of LATAM’s IT outsourcing sector underscores its increasing attractiveness to global businesses, particularly as a nearshore alternative for North American firms seeking efficiency and collaboration advantages.

While LATAM expands, the United States remains a dominant consumer of global outsourcing services, underpinning much of the demand that supports growth in regions like Latin America.

Small Business IT Outsourcing Trends

Small businesses are increasingly recognizing the benefits of outsourcing, particularly in IT, to overcome resource limitations and boost productivity. These trends contribute significantly to the broader IT outsourcing landscape.

Across small and mid-sized enterprises, accounting and IT services are among the most commonly outsourced functions, as they require specialized skills that may be costly to maintain in-house.

According to recent market data, around 37% of small businesses outsource at least part of their business processes, signaling that over one-third leverage external service providers to handle functions ranging from IT support to administrative workloads.

Similarly, about 37% of small and midsize IT organizations expect their spending on IT outsourcing services to increase over the next three years, reflecting confidence in the value of external IT partnerships to manage operations, access technical expertise, and enable technology adoption.

Summing Up

The IT outsourcing trend is clearly not just a temporary shift but a strategic imperative for businesses seeking to thrive in today's competitive digital landscape. From cost optimization and access to specialized skills to enhanced agility and faster time-to-market, the benefits are undeniable.

As we’ve explored, this IT outsourcing trend is shaping markets globally, with established powerhouses like India maintaining their dominance while dynamic regions like Vietnam emerge as attractive alternatives. By understanding these key statistics and evolving trends, organizations can make informed decisions to maximize the value of their IT investments.

Are you ready to leverage the IT outsourcing trend to propel your business forward? BHSoft, with our expertise and presence in Vietnam, can help you navigate this complex landscape and develop a tailored outsourcing strategy. Contact us today for a consultation.